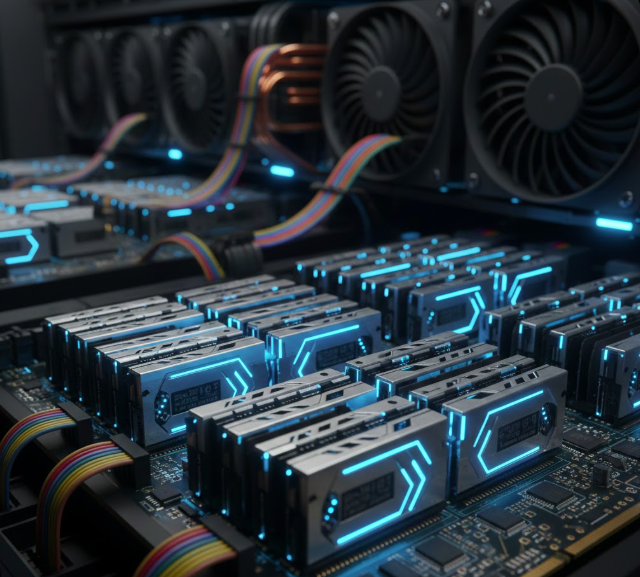

Memory crisis in the IT world - what's happening now and how does it affect you as a customer?

In recent months, we have seen clear signs of a new global bottleneck in the IT industry – this time linked to memory. DRAM, NAND and more advanced memory types are being used today at a rate that the market was simply not prepared for. For our customers, this means higher prices, longer delivery times and, in some cases, more difficulty in planning future IT investments.

Why is the memory crisis happening now?

The short version is that AI is changing the landscape for the entire semiconductor industry.

Rapid developments in artificial intelligence, particularly generative AI and advanced machine learning, have led to a clear shift in how the world’s memory manufacturers prioritize their production. Modern AI systems require huge amounts of very high-performance memory, such as HBM and DDR5 in large configurations.

Manufacturing capacity has therefore been largely redirected towards:

AI accelerators and GPU-based systems

large hyperscale data centers

higher-margin products linked to AI training and inference

At the same time, memory manufacturing is both capital intensive and time consuming to scale up. New factories and production lines take years to complete, which means that supply cannot keep up with rapidly increasing demand.

In addition to this, we also see effects of:

stockpiling and precautionary purchasing in the supply chain

reduced buffer stocks at distributors

currency fluctuations and increased geopolitical uncertainty

All in all, this creates a situation where memory becomes both more expensive and more difficult to obtain.

What does this mean in practice?

For the market as a whole, and for you as a customer, this is noticeable in several ways.

Memory components represent a significant part of the cost of servers, storage systems, client computers and other infrastructure. Therefore, when memory prices rise, it has a direct impact on the final price of complete systems.

At the same time, we are clearly seeing extended delivery times. Lead times that used to be a few weeks can now stretch over several months, which in turn affects project plans and commissioning.

In a more volatile market, it also becomes more difficult to guarantee prices over a longer period. Price adjustments by manufacturers can occur at short notice, affecting the validity of the offer and the predictability of investments.

Finally, larger global volumes are often prioritized in the allocation of components, which can make supply more limited even in the Nordic market.

Importantly, this is not considered to be a short-term disruption, but rather a structural change that is likely to extend beyond 2026 and beyond.

Our recommendation to you as a customer

At Aixia, we actively work to help our customers manage these types of market changes, but in today’s environment, foresight and dialog are more important than ever.

We therefore recommend that:

investments and upgrades planned earlier than normal

critical system configurations and memory choices are locked in good time

alternative architectures or solutions are discussed where possible

price changes and adjusted delivery times are taken into account in planning

Working more proactively can often reduce both risk and uncertainty.

A market situation that requires cooperation

The memory crisis is fundamentally a consequence of the technological developments that many organizations want to take advantage of – AI, data-driven innovation and high-performance IT environments. At the same time, it places new demands on how we plan, procure and collaborate.

Our ambition at Aixia is to be a long-term partner even when the market is complex and changing. With the right dialog, technical competence and realistic expectations, it is possible to make informed decisions even in a challenging situation.

If you have any questions or would like to discuss how this affects your IT environment, you are always welcome to contact us.

Petter Ahlén

Sales Manager

Aixia AB